401k Participant Update: Q & A with a 401k Advisor

By: ANTHONY MCCALLISTER, AIF®, J.D., Senior VP, Wealth Advisor

We have held many 401(k) group meetings, one-on-one meetings, and phone calls with 401k participants this year. Understandably, participants are concerned with the markets and their 401(k) accounts. What follows are a couple of the common questions we’ve been asked and our general responses.

Question:

I am tired of contributing to my 401k and seeing it decline in value. Should I stop funding my 401k until the market stabilizes?

Answer:

We generally believe it best to continue contributing to your 401k to take advantage of dollar cost averaging. Contributing consistently is an important step in preparing for your retirement. You control your payroll deductions directly from your paycheck, helping to make this a simple and effortless process. Coupled with the principle of dollar cost averaging, this consistent payroll deducted contribution into your 401k throughout your working career can help you reach your retirement goals. Dollar cost averaging is the investment of equal amounts of money at standardized points over time, regardless of the price of the underlying securities. This can lower the impact of price volatility, as we are experiencing currently, and can lower the average cost of the investments being held.

Question:

My account has declined in value this year. Should I move my account into something safe (i.e., the money market, stable value, guaranteed account, or other cash equivalent) until I see the market rebound and I feel better about it?

Answer:

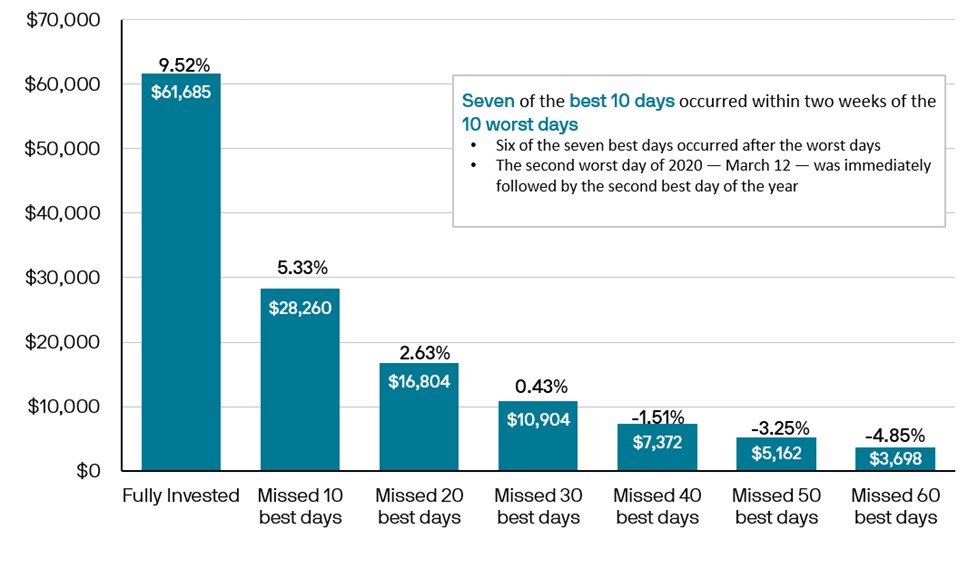

While everyone’s situation is different, we do not recommend trying to time the market; we believe it is better to focus instead on long-term investing. Timing the market includes when an investor moves some or all of their stock investments to cash in an attempt to avoid a market decline and with the hope of later reinvesting into a market rebound. While this sounds like a good strategy, this requires a participant to make two correct decisions: when to sell and when to buy. In the previous 12 bear markets of the S&P 500 Index, the index had positive returns a year following entering the bear market in all instances but three. The average one-year return was 23.9%. But reviewing each of these 12 bear markets individually on a one-month, three-month, six-month, and one-year basis, the returns they experienced differ significantly, making timing when to enter back into the market very difficult. (https://www.wsj.com/livecoverage/stock-market-today-dow-jones-bitcoin-fed-rates-06-14-2022/card/how-the-s-p-500-performs-after-closing-in-a-bear-market-yBwgfJwW8HGSNJaKg6LB).

It is very difficult to time when to leave the market to avoid market declines. It is equally as difficult to determine when to reinvest an account at the opportune time in order to experience any market rebound. We believe the best course of action is to maintain an appropriate, diversified mix of stocks and bonds, investing for the long-term in light of a dynamic plan for reaching your retirement goals.

In these difficult markets, we recommend holding fast to investment principles of resisting the urge to sell equities into declining markets, not attempting to time the market, focusing on investing with a long-term financial plan in mind, and continuing saving through dollar cost averaging. Do not hesitate to contact your CapSouth Financial Advisor to schedule a time to discuss your individual situation and to review your accounts.

CapSouth Partners, Inc, dba CapSouth Wealth Management, is an independent registered Investment Advisory firm. Any opinions expressed in the material are those of the author and are not presented as facts. Information provided by sources deemed to be reliable. CapSouth does not guarantee the accuracy or completeness of the information. CapSouth does not offer tax, accounting or legal advice. Consult your tax or legal advisors for all issues that may have tax or legal consequences. This information has been prepared solely for informational purposes, is general in nature and is not intended as specific advice. Any performance data quoted represents past performance; past performance is no guarantee of future results. The S&P 500 Index is an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Indices do not include fees or operating expenses and are not available for actual investment. This article contains links to third party content (content hosted on sites unaffiliated with CapSouth Partners). CapSouth makes no representations whatsoever regarding any third party content/sites that may be accessible directly or indirectly from this article. Linking to these third party sites in no way implies an endorsement or affiliation of any kind between CapSouth and any third party, including legal authorization to use any trademark, trade name, logo, or copyrighted materials belonging to either entity.

401k Advisor, 401k Consulting, 401k Contributions, Market Stabilization, Stock Market