Social Security: The Elephant in the Room

For most Americans, Social Security has represented nothing more than some unavoidable payroll deduction with the positively cryptic initials of “FICA” and “OASDI” (Federal Insurance Contributions Act and Old Age, Survivors and Disability Insurance). It hinted at a future that seemed both intangible and faraway.

Yet, many Americans now sit on the cusp of drawing on the promise that was made with those payments.

As the growing wave of citizens approach retirement, questions and concerns abound. Is Social Security financially healthy? How much will my income benefit be? How do I maximize my benefits for me and my spouse? When should I begin taking Social Security?

Questions & Elephants

Answering these questions may help you derive the most from your Social Security benefit, and potentially enhance your financial security in retirement. Before you can answer these questions, you have to acknowledge the elephant in the room.

The Social Security system has undergone periodic scares over the years that has inevitably led many people to wonder if Social Security will remain financially sound enough to pay the benefits they are owed.

Reasonable Concern

Social Security was created in 1935 during Franklin D. Roosevelt’s first term. It was designed to provide income to older Americans who had little to no means of support. The country was mired in an economic downturn and the need for such support was acute.1

Since its creation, there have been three basic developments that have led to the financial challenges Social Security faces today.

- The number of workers paying into the system (which supports current benefit payments) has fallen from just over 8 workers for every retiree in 1955 to 3.3 in 2005. That ratio is expected to fall to 2.1 to 1 by 2040.2

- A program that began as a dedicated retirement benefit later morphed into income support for disabled workers and surviving family members. These added obligations were not always matched with the necessary payroll deduction levels to financially support these additional objectives.

- Retirees are living longer. As might be expected, the march of medical technology and our understanding of healthy behaviors have led to a longer retirement span, potentially placing a greater strain on resources.

Beginning in 2010, tax and other noninterest income no longer fully covered the program’s cost. According to the Social Security Trustees 2014 annual report, this pattern is expected to continue for the next 75 years; the report projects that the trust fund may be exhausted by 2040, absent any changes.3

Social Security’s financial crisis is real, but the prospect of its failure seems remote. There are a number of ways to stabilize the Social Security system, including, but not limited to:

- Increase Payroll Taxes: An increase in payroll taxes, depending on the size, could add years of life to the trust fund.4

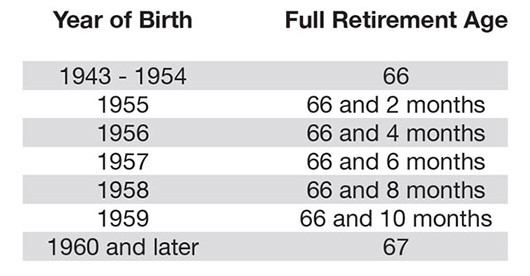

- Raise the Retirement Age: This has already been done in past reforms and would save money by paying benefits to future recipients at a later age.

- Tax Benefits of Higher Earners: By taxing Social Security income for retirees in higher tax brackets, the tax revenue could be used to lengthen the life of the trust fund.

- Modify Inflation Adjustments: Rather than raise benefits in line with the Consumer Price Index (CPI), policymakers might elect to tie future benefit increases to the “chained CPI,” which assumes that individuals move to cheaper alternatives in the face of rising costs. Using the “chained CPI” may make cost of living adjustments less expensive.

Reform is expected to be difficult since it may involve tough choices—something from which many policymakers often retreat. However, history has shown that political leaders tend to act when the consequences of inaction exceed those taking action.

To learn more about CapSouth Wealth Management, visit our website at www.capsouthwm.com

1. Social Security Administration, 2020

2. Social Security Administration, 2020

3. Social Security Administration, 2020

4. Social Security Administration, 2020

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with CapSouth Wealth Management. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Copyright 2020 FMG Suite.

CapSouth Partners, Inc., dba CapSouth Wealth Management, is an independent registered Investment Advisory firm. CapSouth does not offer tax, accounting or legal advice. Consult your tax or legal advisors for all issues that may have tax or legal consequences.