A Shallow Dive Into Alternative Investments

In what has been a limited but quite eventful career in finance, I frequently get asked by people how they should invest their money. As in most cases, there is no “one size fits all” answer to that question. The phrase “It depends” is used quite often in our company as many factors must be considered before making an investment decision. Warren Buffett might tell you to invest in a low-cost index fund and leave it alone for 30 years. Others may say that cash is king and to stick it under your mattress. Still, others may say to buy the newest Crypto-Token-NFT-Chain (I know that is not a real thing). The answer is rarely as simple as any of these options I mentioned, and I spend the majority of the day trying to answer what seems like a simple question, “How do I invest this money?” If you have paid attention to just about any type of media lately, you know that the stock market is not having its best run this year. With inflation at the highest level in 40 years and the Fed hiking interest rates three times already, and likely another next month, there does not seem to be a good answer to how to invest in these tumultuous times. Not since 1994 have we seen negative returns in both the stock and bond market, and cash is losing purchasing power due to the high inflation. So where do you hide? One such possibility is becoming more and more relevant and, fortunately, more available to investors. This is what the investment world calls Alternative Investments.

What are Alternative Investments

Alternative Investments are considered financial assets that do not fall into one of the conventional investment categories, such as common stocks, bonds, and cash. Sometimes called the private market, alternative investments cover many different categories such as private equity, private debt or credit, real estate or real assets, hedge funds, venture capital, futures, derivatives, and so forth. Alternative Investments (Alts) attempt to have the same outcome as public markets as they seek to generate return, provide growth, and protect assets while diversifying investments from the public market. Often, these investments have a low correlation to the public market allowing; many have less volatility than public markets and a lower risk profile in a portfolio. Until recently, Alternative Investments were only available to institutional investors and not the retail market. Regulatory changes and innovations in products and services have opened the world of Alts to a much broader market. In the past, retail and even high net worth investors had limited access to Alts due to high investment minimums, liquidity limitations, and accreditation requirements, however, a shift in focus has allowed a much larger number of investors to qualify and benefit from private investments. In many cases, investment minimums have declined, subscription processes have become more streamlined, and funds have even begun trading on the open market, albeit they are usually less liquid than your normal stocks or ETFs and may still have a hold period for liquidation. Investors are now able to differentiate their portfolios even further by using Alternative Investments as a standard in their investment process.

Why Invest in Private Markets

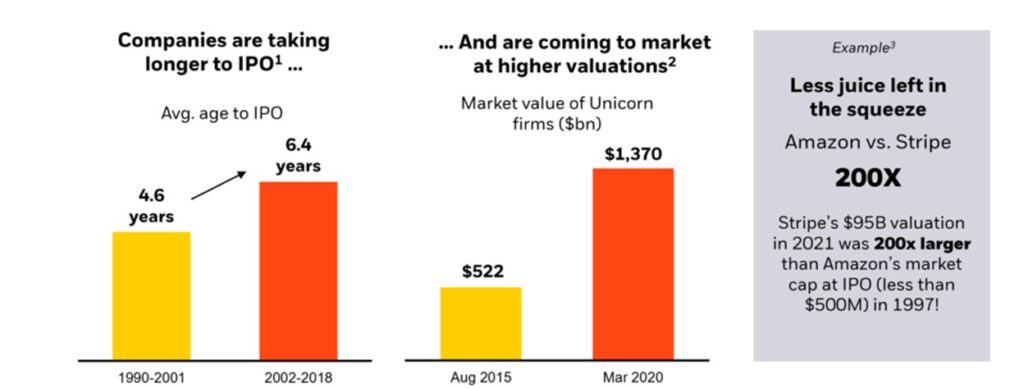

In current market conditions, it is now more important than ever to consider investing in private markets as valuations are fundamentally driven and not as impacted by market sentiment. In other words, news cycles, social media, and CEO popularity have much less impact on the companies’ valuations than those available in public markets. Through the use of private equity investments, companies are able to stay private much longer, without needing the investment from joining the public markets, and investors are able to benefit from a longer duration in the private market – kind of a chicken and egg situation. Much economic growth is now taking place in private markets as IPO’s are reaching the market at increasingly higher valuations, often leaving less potential for investment return once a company does go public.

- Source: National Venture Capital Association. Data as of 12/31/19.

- Source: Journal of Applied Corporate Finance. Private Equity and Public Companies. “The Growing Blessing of Unicorns: The Changing Nature of the Market for Privately Funded Companies.” Keith C. Brown and Kenneth W. Wiles, University of Texas at Austin. Sample set was determined as follows: The demographic and financial characteristics for sets of active unicorns at two different points in time: August 31, 2015 (the sample from our original study) and March 1, 2020. As before, to be included in either sample, a company must satisfy the following conditions: (1) have always been private; (2) have received at least one funding round of institutional capital; (3) not be a divisional buyout of a public company; and (4) have an estimated market valuation of $1 billion or more. Throughout the entirety of the surveying process, the identity of and data for these samples were gathered from several sources, including CB Insights, Capital IQ, CrunchBase, PitchBook, Preqin, and Wells Fargo, as well as their own research.

- Sources: Stripe; “Stripe has raised a new round of funding to accelerate momentum in Europe and reinforce enterprise leadership.” Stripe data as of 3/14/21. Amazon: https://techcrunch.com/2017/06/28/a-look-back-at-amazons-1997-ipo/.

Large Private Equity funds generally hold a portfolio of companies, and successful fund managers purchase companies that have the potential to add value to the overall portfolio. In other words, they look to have the portfolio companies feed off each other, and, by extending their holding period, they are allowed adequate time to create value by implementing crossover initiatives. Investments in private debt and private credit focus more on providing a greater yield and overall return, than the public fixed income market while also maintaining and possibly increasing the value of their holdings. This is especially important at this point in time, as rising interest rates have historically caused a loss of value due to duration risk – something constantly discussed in investor meetings. Private real estate funds also focus on providing a yield, but with further potential advantages: growth opportunity due to property appreciation, tax advantages due to property depreciation, and the ability for real assets to hedge inflationary risks.

How Do Alternatives Deliver

When most people speak of investing, they are most familiar with one market, stocks listed on U.S. stock exchanges, which are public, liquid, and provide timely information to anyone who is interested. People rarely think about another, much larger market, the private market, where information is not as transparent and investments are generally not as liquid. For those unfamiliar with the investing term “liquid” (or liquidity), surprisingly, we are not discussing a favorite drink. Liquidity is referred to as how easily an asset can be converted to cash. Assets like stocks and bonds that trade on the public market can be converted to cash in a day or two. Alternative Investments are generally not as liquid, meaning you cannot just sell them over the counter and see your money quickly. There can be lock-up periods, partnership votes, property sales, long-term contracts, and many other protocols to convert an investment back into cash. Because of this lower liquidity, investors in private markets can demand a greater return on their investment, called a liquidity premium. Keep in mind that just because an investment is illiquid does not mean it guarantees positive returns or any return level; however, companies are generally willing to pay more for extended use of funds.

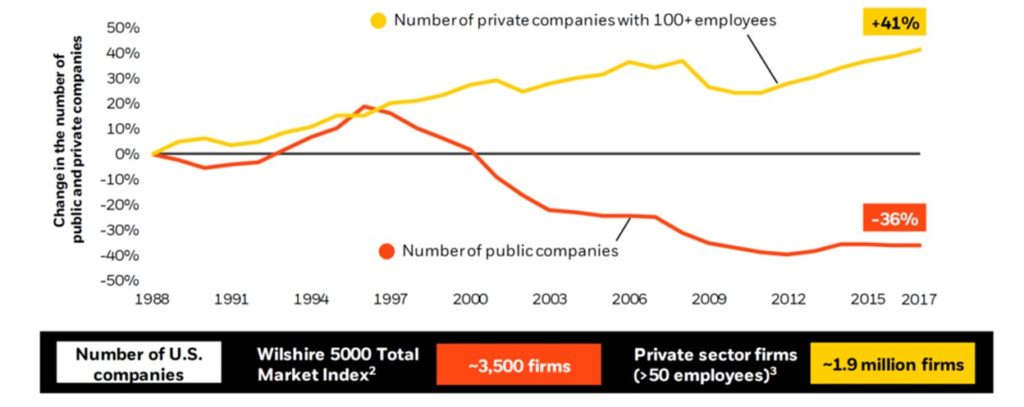

Going back to the overall size of the private market, we often think the public stock market composes the vast majority of the market. However, the private company universe is magnitudes larger than the public market. According to the US Census, there are approximately 6 million companies with employees in the U.S., only about 5,700 of which are listed on the New York Stock Exchange and the NASDAQ combined.1

1. Source: U.S. Census Bureau – Statistics of U.S. Businesses; Droidge, Karolyi and Stulz (1988-2017). Represents the latest data available as of 2/5/21.

2. Source: www.wilshire.com. As of 2/5/21.

3. Source: Kaiser Family Foundation, 2019 data; www.kff.org. Data updated as of 2/5/21.

Information, or lack thereof, is another driver of return for private investments. The SEC, or Securities and Exchange Commission, requires publicly listed companies to provide potential investors with annual reports and other disclosures containing information regarding their finances, strategies, and operating procedures. These rules theoretically allow all investors to be on the same playing field when evaluating an investment. Private companies are not required to provide investors with the same level of information and disclosures and, therefore, are more difficult to value, which in turn leads to the need for more educated investment decisions.

Are Private Investments Risky

Just like any other investment, or for that matter, any other decision we make in life, Alternative Investments pose certain risks. Interestingly enough, the same traits that make private investments valuable are also what make them risky. As discussed before, the lack of transparency in private markets, as opposed to public markets, leads to both risk and, hopefully, reward. Similarly, the liquidity premium you expect to be paid could also be detrimental if you were to have a need to redeem your investment in a timely manner. It is imperative to look at private investments over a long-term horizon and only invest funds that would not be needed in the near future. Some alternative investments also require investors to become partners in the fund, venture, property, etc., so it is essential for investors to understand the structure of the deal and confirm they are limited to loss of investment only and are not on the hook for further investment. Finally, alternatives can be highly concentrated, adding to a level of risk not generally found in ETFs, Mutual Funds, or market indexes.

In closing, Alternative Investments can be an impressive source of return, growth, and protection for many investors. Still, they should normally be considered a part of the overall portfolio, not the entire investment strategy. Anyone wanting to invest or learn more should read, research, and then speak to their tax, legal, and financial professionals about Alternative Investments before diving in head-first.

To discuss this article further contact Peter Ramsey at pramsey@capsouthparters.com or to learn more about CapSouth Wealth Management, visit our website at www.capsouthwm.com or https://capsouthwm.com/what-we-do/investment-management/. Call 800.929.1001 to schedule an appointment to speak with an advisor.

Investment advisory services are offered through CapSouth Partners, Inc, dba CapSouth Wealth Management, an independent registered Investment Advisory firm. Information provided by sources deemed to be reliable. CapSouth does not guarantee the accuracy or completeness of the information. CapSouth does not offer tax, accounting, or legal advice. Consult your tax or legal advisors for all issues that may have tax or legal consequences. This information has been prepared solely for informational purposes, is general in nature and is not intended as specific advice. Any performance data quoted represents past performance; past performance is no guarantee of future results.