I’d like to address the elephant in the room. This year has been incredibly volatile for the stock market, and we’ve experienced some steep declines. It can be frustrating, confusing, and even frightening. Currently, we are in a bear market. Perhaps you have heard the term before and understand the feeling associated with a bear market but aren’t exactly sure what it is (besides scary). A bear market is when a market experiences a prolonged drop in investment prices. This is typically referenced when a broad market index falls by 20% or more from its recent high. There is tremendous noise in the media. Many investors are anxiously looking at account balances more frequently, particularly after experiencing a long run for the bull market. Experiences with past down-market events may be triggering strong feelings of concern. One of my greatest strengths is being able to stay calm in difficult situations and it serves me well as an Advisor. To help you tackle a difficult situation head on in hopes of instilling some calm in the chaos, I’ll discuss three things to consider in a bear market

Communication with your Advisor is Critical

I love talking to my clients. They share their dreams and lives with me. They trust me enough to delegate a large amount of their financial life to me. It’s very difficult to do my job well without clear and consistent communication from clients. It’s also difficult to plan for clients without truly understanding how they feel about risk, how they view money and even some of the personal biases they may have in their approach due to previous experiences. Some of my clients have never worked with an Advisor before working with me while others have unfortunately had very negative experiences working with an Advisor which is why they sought a change. For some, I serve as a sounding board and for others I offer trusted advice and guidance. The one unofficial role I never knew I would take on is counselor.

We often think of money as transactional. Most of our money exchanges are even labeled as transactions. We use labels such as “good” and “bad” to describe debt, investments, and even Advisors. We spend a great deal of time thinking about what we want to do with our money as well as thinking about what our money is doing in the markets. We don’t often talk about how we feel about money or our life experiences with money. This is ironic as the field of Behavioral Finance is growing. Research consistently indicates that client behavior is also a key indicator of financial success. One of the leading organizations in the financial planning industry, FPA, recently announced a new partnership to offer its members a Psychology of Financial Planning Specialist program. Covered in the program are topics such as Behavior Finance for Financial Planners, Counseling in Financial Planning Practice, and Implementing Financial Psychology into Practice. The industry has recognized what we as individuals may not be able to see right in front of us – dealing with money comes with a lot of emotion. It’s time we start talking about it.

While I believe communication is always important, communicating with your Advisor during a bear market about how you are feeling is crucial. A client recently shared that this was the first time they have ever felt uneasy. We had a long conversation about why they felt uneasy. We had reviewed the financial plan and were well in the confidence zone. There was plenty of cash to fund their needs for an extended period. We began to peel back the layers and have the hard conversations around emotions. Throughout the conversation I learned that when I said “everything is fine” the client perceived that as being dismissive. While that was never my intent, their honesty and vulnerability allowed me to clear the air and lean into even deeper conversation. I decided to ask the client a very tough question – are you uneasy because you have lost trust in me? Thankfully, they had not. After a while, they shared that they felt uneasy because it was the first time that they were experiencing a bear market while in retirement. It was scary to see the losses while on a fixed income. The client’s vulnerability in sharing those feelings took courage. We walked back through their financial plan, discussed “what ifs” and discussed how we might address them in the future. We didn’t abandon the plan and we didn’t make any sudden investment changes that were out of scope of the plan.

During this bear market, if you find yourself dealing with emotions that are new or ones you haven’t experienced in a while about your money, please tell your CapSouth Advisor. We truly care about you and we are here to listen. It is our responsibility to coach and guide you through the emotions so that we can limit behavioral influences. There is an adage that says, “the only people that get hurt on a roller coaster are the ones who jump off”. Advisors often use this to explain how behavioral changes impact money such as selling when the market is declining. We understand the emotions and we will spend the time needed to address concerns. Let us serve as the safety bar to keep you locked into the seat while we ride this roller coaster together.

Your Financial Plan Has a Long-Term Outlook

One of the things I love most about CapSouth is our dedication to Financial Planning. For most of my life, I only thought of a Financial Advisor as someone who manages money. My experience with them had been limited to those that work in the Broker world as an investment manager. Unfortunately, our industry has limited regulation on how the title Financial Advisor is used. I have had many new clients come to CapSouth with the same limited viewpoint. When I explain that we view investment management as a commodity and that our real value comes in planning, it can be a true mindset shift. Perhaps you had a similar experience when starting to work with us. We ask a lot of questions! We ask for a lot of information. For those that are just starting to work with us, it can be overwhelming although we do our best to make the onboarding process enjoyable. With all the information provided we then craft a financial plan and begin working with you to implement it. We review the financial plan every year in meetings and are consistently adjusting it because life happens. We start to focus more on the Confidence Score to answer the question “am I going to be, okay?”

Like the Wizard of Oz, I’m going to give you a peek behind the Advisor curtain. The Confidence Score is generated through a process called Monte Carlo simulation. So, what is it and why does it matter? Surprisingly, it’s not unique to the financial industry. It’s also used in physics and engineering. In our financial plans, we don’t have the certainty of knowing what the future holds. That includes knowing what the average rate of return will be for your plan. Therefore, the Monte Carlo simulation runs 1,000 trials of your plan using 1,000 different return possibilities to calculate the probability your plan will be successful. While you may not have considered worst case scenarios or bad returns, your financial plan already has.

When we dig into these simulations and look at the 1,000 Trials detail, we can get an even better understanding of the numbers. We can see year data in 5 year increments (Year 5, Year 10, etc.). We can also see End of Plan Dollars and The Year Your Money Goes to $0. These time frames are charted out by Trial Percentile. They include 1%, 25%, 50%, 75% and 99%. My personal plan has a Confidence Score at 88% (at time of writing this). When I look at these trials, I can see that in the very best scenario my plan would end with more money than my husband and I would know what to do with and would need a fantastic estate plan. I can also see that in the very worst scenario, we would run out of money in the year 2049. Does that scare me? Not at all. The reason? It’s an extremely unlikely scenario just like the one that looks amazing. The most realistic scenario is somewhere in between, and it’s why my Confidence Score is reassuring. (Friendly reminder here: This is not like school where the highest score is the best score. If my score is in the blue zone, it is considered an overfunded plan, and I need to ensure my estate plan is in order because I will likely be leaving money to heirs).

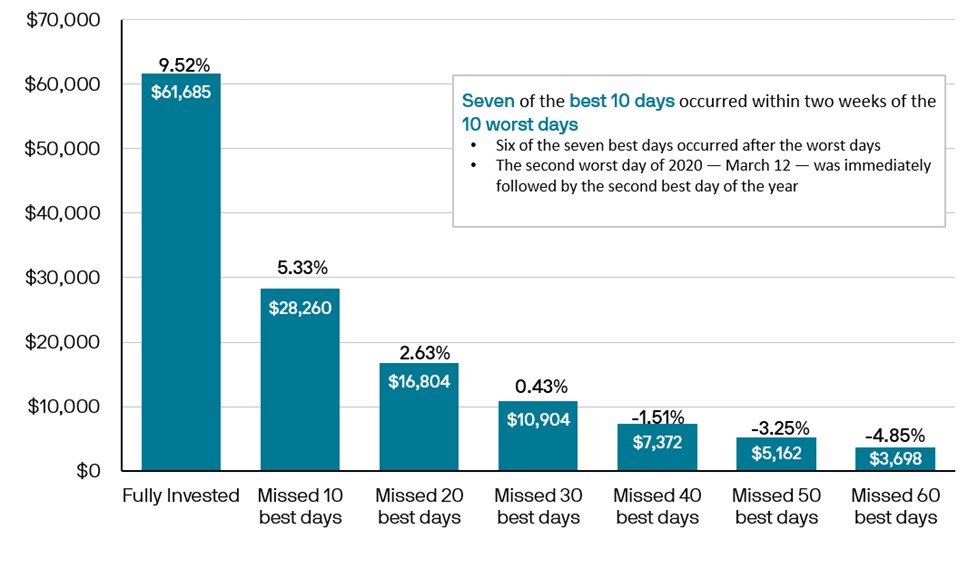

We don’t often get into these types of details in meetings because it can be data overload. The key takeaway right now during a bear market is that your financial plan is not surprised by a down market with negative returns. Neither is your Advisor. We take a long-range approach and understand that markets go down just like they go up. Historical charts show that the markets have always recovered. While history is not a predictor of the future, it does give us data to consider. While it can be difficult to zoom out when emotions are high it is important to remember the decisions made together with your Advisor when times were not as tumultuous.

It’s Not All Doom and Gloom

When we set the fear and frustration of a bear market aside for a moment, we can turn our focus to the bright spots in this market. No, I’m not talking about a “sweet deal” a friend is telling you about or even buying treasuries at 4%. I’m talking about the planning opportunities that present themselves during a bear market.

If you are still working or have cash on the sidelines, it’s an excellent opportunity to dollar-cost average new money into the market. If you are participating in a company retirement plan, it’s likely that you are already using this approach. Each time you contribute to your 401(k) you are investing new money. This may be weekly, bi-weekly, or twice a month depending on how your payroll is processed. It’s a great buying opportunity. I like to say we’re buying on sale and it’s an opportunity we haven’t had in a long time due to high market prices. We may only know that the bottom of the market has occurred when we are able to look back, so trying to time cash into the market isn’t a great approach. By leveraging dollar-cost averaging, you smooth out your investment purchases and remove market timing.

Now is also a great time to consider a Roth IRA conversion. Roth conversions are a part of our normal consideration process for clients with IRAs, but they are particularly appealing when markets are in decline and your portfolio value may be lower. Conversions now may increase the likelihood of tax free growth as the market recovers. You may even be able to save on the tax bill you are paying now for that conversion due to the lower portfolio value. Less taxes and increased potential of tax free growth? That sounds like a great opportunity to be considering in a bear market.

A bear market also presents you with the opportunity to revisit your market risk tolerance. Are you feeling different now than how you felt when you originally discussed your risk tolerance with your Advisor? Perhaps you overestimated how much risk you could tolerate and need to evaluate dialing back market risk long term. The opposite could also be true. You may have always feared the worst and now, faced with a bear market, you aren’t as bothered as you thought you would be. These are valuable, real-time insights that can help you and your Advisor plan for the long term.

Above all else, remember that you are not alone. You are a part of the CapSouth family, and we value our long-term relationships with clients. We are here in the good times and in the bad. Do not hesitate to reach out to your Advisor at any time.

To discuss this article further or to learn more about CapSouth Wealth Management, visit our website at www.capsouthwm.com or call 800.929.1001 to schedule an appointment to speak with an advisor.

by: Jennifer Fensley, CFP®️,CRPS®️

Investment advisory services are offered through CapSouth Partners, Inc, dba CapSouth Wealth Management, an independent registered Investment Advisory firm. Information provided by sources deemed to be reliable. CapSouth does not guarantee the accuracy or completeness of the information. CapSouth does not offer tax, accounting, or legal advice. Consult your tax or legal advisors for all issues that may have tax or legal consequences. This information has been prepared solely for informational purposes, is general in nature and is not intended as specific advice.